Federation Chamber on 12/02/2024

Federation Chamber - PRIVATE MEMBERS' BUSINESS - Financial Abuse

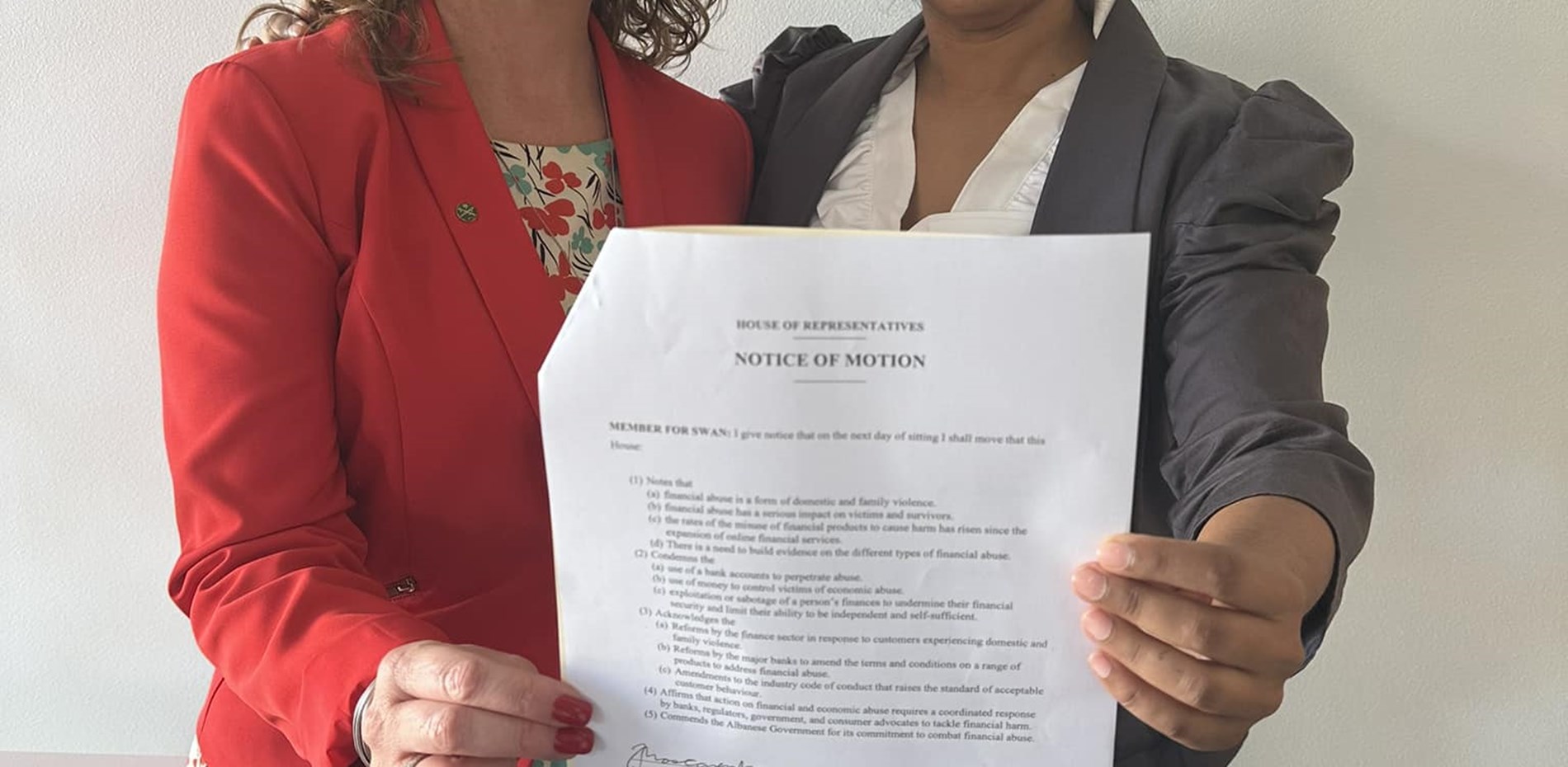

Ms MASCARENHAS (Swan) (16:45): I move:

That this House:

(1) notes that:

(a) financial abuse is a form of domestic and family violence;

(b) financial abuse has a serious impact on victims and survivors;

(c) the rates of the misuse of financial products to cause harm has risen since the

expansion of online financial services; and

(d) there is a need to build evidence of the different types of financial abuse;

(2) condemns the:

(a) use of bank accounts to perpetrate abuse;

(b) use of money to control victims of economic abuse; and

(c) exploitation or sabotage of a person's finances to undermine their financial

security and limit their ability to be independent and self-sufficient;

Privacy - Terms

(3) acknowledges the:

(a) reforms by the finance sector in response to customers experiencing domestic

and family violence;

(b) reforms by the major banks to amend the terms and conditions of a range of

products to address financial abuse; and

(c) amendments to the industry code of conduct that raise the standard of

acceptable customer behaviour;

(4) affirms that action on financial and economic abuse requires a coordinated

response by banks, regulators, government, and consumer advocates; and

(5) commends the Government for its commitment to combat financial abuse.

It's total control. Controlling someone's money, controlling someone's access to the

bank account, tracking someone's spending, sending abusive or threatening

messages via banking transactions, forging a signature, taking out a loan in

someone else's name, stopping someone from working or forcing someone to work,

refusing to contribute financially—these are all examples of financial abuse. It's a

powerful, insidious and pervasive form of abuse, and that's why I'm making an effort

to bring this conversation to national attention.

Our Watch defines financial abuse as 'someone using money or finances to hurt or

control someone else'. It's abuse that can happen to anyone. It does not discriminate

between rich or poor, between educated or uneducated, or by gender or age. In fact,

the Australian Bureau of Statistics reported in 2021 that an estimated 1.6 million

women and 745,000 men have experienced partner financial abuse. Bankwest

reports that one-third of Western Australians have experienced or know someone

who has experienced financial abuse, four in five agree that it is a widespread

problem and one in seven admit to having been perpetrators of financial abuse.

However, it's more difficult to recognise than other forms of abuse. People don't talk

about money in our culture. People don't see it as a form of abuse. And women have

a tendency to not talk about finances in their social circles. Some people don't even

realise that it's happening until it's too late. It makes it a hidden epidemic.

What I often talk about with people in my electorate is that financial abuse is often a

red flag for other forms of abuse later on. It undermines a woman's financial

independence, it limits her choices, it limits her freedom and it can leave victims-

survivors in debt or poverty for years. It's often why women find it hard to leave an

abusive relationship. It can be an early sign that there is yet more to come: physical,

emotional and psychological abuse.

Life has moved online, and so have our financial institutions. While it brings so many

benefits to us, it exposes women to another form of abuse, and we need to make

sure that our financial institutions keep up. Some of the major banks have been

taking up the challenge, training staff and banning perpetrators. Looking at the

design of our banking products is the next step. And what about the consequences

for perpetrators of financial abuse?

The issue is complex. Just last week I met with the Indian crisis centre, experts in

dowry abuse. As for migrant women, visas are used to control them and take their

money. Imagine going to work, getting paid and not even seeing that money. With

the additional threat of being told that you could have to leave the country, it results

in a significant power imbalance. This is the reality for too many women in our

society.

I also acknowledge the member for Aston, who will soon be seconding this motion,

and the brave women who have helped campaign on this particular issue. I want to

acknowledge victims-survivors, and advocates such as Rebecca Glenn at the Centre

for Women's Economic Safety, members of the newly formed Economic Abuse

Reference Group in WA and other groups around Australia. We need prevention but

we also need solutions. We need a coordinated approach by banks, regulators,

government and consumer advocates.

Stopping all forms of violence against women is a priority for the Albanese

government, which is why we are aiming to eliminate all forms of abuse in one

generation. It's a commitment that's evidenced by Labor's financial investment in

women's safety across the first two budgets. Together we can empower women with

the skills and strength they need. We can change thinking and raise awareness so

that people will understand financial abuse and that it's simply not okay.

The DEPUTY SPEAKER ( Mr Young ): Is the motion seconded?

Ms Doyle: I second the motion and reserve my right to speak.

Mr CONAGHAN (Cowper) (16:50): I have spoken many times in

this place, as the assistant shadow minister for the prevention of family violence,

about the scourge on our society and on our families in all its forms. I've spoken

about the need to break the generational cycle and all the policies that are required

for prevention. If we don't do that—if we don't look at a generational approach—

then, in the words of victim-survivors, they will eternally be the ambulance at the

bottom of the cliff. We need to put that fence there, though systems there to prevent

our victims from falling.

As we know, domestic abuse constitutes much more than simple physical violence.

As we're aware, coercive control is where someone uses a pattern of abusive

behaviour against another person. This can include nonphysical behaviours that instil

uncertainty and fear of reprisal in an individual. Financial coercion is a form of

coercive control that quite often goes unnoticed by friends and loved one's. It's very

easily hidden away from view. The controlling partner managers the money. The

reality is that financial coercion is a primary tool of domestic abusers to subjugate

and disempower their victims. That is their whole intention. Without independent

access to funds, victims are unable to put steps in place to escape an abusive

situation, rendering themselves powerless.

With the increasing push to online services, it's far easier for would-be abuses to

open, drain, deny access or close accounts without raising suspicions. With that in

mind, I am very pleased to see the move by many of our financial institutions to

recognise the existence and pervasive impact of coercive control in the domestic

abuse space and to put conditions in place to stop it.

Having said that, our bank tellers and officers are not police officers, and there need

to be some very strong guidelines in place to help them. I'm not stepping back from

what I have said. This is very important legislation to ensure that it doesn't happen to

our victims, our victim survivors and our elderly. It is not just those in the considered

domestic male or female role; it is also sons, daughters and grandchildren who also

can be seen to enter into this coercive control on elderly people. The Australian

Banking Association industry guideline 'Preventing and responding to family

domestic violence' states:

When a bank is aware of family and domestic violence, or suspects it may be

occurring, the bank will work to support the customer wherever possible.

For the guidelines that need to be given to our bank tellers, to those working in the

industry, I think it's really important that we ask these three questions. What

guidelines do the banks have to establish the veracity or information about an

account being used for financial control? What lawful authority do the banks have to

investigate and make assessments on the nature and conduct of transactions in

customers' joint or accessible accounts? What processes are in place to determine the

risk that may arise for a joint account holder denying access to the perpetrator?

These questions need to be answered to provide that structure for those working in

our banking industry. I would hate to think that a 22-year-old teller remained silent

because he or she was unaware of the guidelines and processes that should, and no

doubt will, be put in place for him or her. We have to do everything we can for

victims, particularly when it comes to financial coercive control.

Ms DOYLE (Aston) (16:55): I'm very pleased to speak on the

motion put by the member for Swan as this is an issue that I care about deeply.

Financial abuse takes many forms. It can be checking over the items when you come

home from shopping and questioning why certain things were purchased. If done

repeatedly over time it can leave a person feeling like they have to constantly justify

their needs and wants, as if they are not important. It can be having to hand over

your entire wage into a joint bank account and having it managed entirely by your

partner, only having a certain amount of pin money doled out each week. It's the

whole attitude of, 'Don't worry about it, honey; I'll take everything.' Or you can be

told that you don't need to work, that you'll be taken off completely, but years later

find out that you've been taken advantage of in ways that you had no idea about,

such as signing mysterious documents which turn out to be legally binding.

Years after a relationship like this has ended, a woman can find herself with barely

any superannuation, stripped of years of work experience, deskilled and with little

self-esteem left over. Financial abuse can happen over many years, sometimes

without a person even realising what's going on. It wreaks havoc with one's selfesteem and confidence and is designed to keep someone under another's control.

The Albanese government has invested $2.3 billion in women's safety, including

more than $326 million in prevention initiatives specifically, across our first two

budgets. Last year, our government, along with the states and territories, released

the National Plan to End Violence Against Women and Children 2022-2032. This plan

specifically recognises that financial abuse is a common form of domestic and family

violence. It is perpetrated by intimate partners or family members and also occurs in

the context of elder and carer abuse. It manifests in different ways, but generally it is

a type of controlling behaviour where the perpetrator controls finances and assets to

gain power and control in a relationship.

The safety of women and children experiencing family, domestic and sexual violence

is a national priority for the Albanese government, and our governments believe

women and children experiencing violence should not be forced to remain in unsafe

situations due to financial barriers. A woman I know in my electorate told me a story

of how her husband put a stop on their joint bank account when their relationship

was breaking down. She was then unable to access her pay for a fortnight which had

just been paid in. Her husband knew that this was the account her pay went into and

knew she would not be able to pay her credit card off that month. What upset her the

most was that the bank was able to do this without even alerting her first. There was

not even a phone call. She was the other named account holder. No bank should be

able to do this to a woman.

Financial abuse can also be withholding child support payments from an ex-partner

to punish them, even though child support is specifically for the upkeep of a child

who a person has helped bring into the world to help pay for their clothes, food, the

electricity and internet in their home, the rent or mortgage on that home, their

education and everything else involved with raising a child.

Just last Friday, a woman came into my electorate office to talk to me about an issue

that affects many women like her across this country, that of unpaid child support.

She has done everything right. She has contacted the Child Support agency

numerous time about the unpaid payments, but because of the creative accounting

of her ex-husband, who is not short of money, he is able to find various avenues to

escape down to avoid paying what is owed to her for the upkeep of their children.

He, like a lot of ex-partners, uses child support payments in an abusive way against

his former partner to hurt her and, in turn, he hurts his children. This is financial

abuse. The woman, who wishes to remain anonymous but who gave permission to

talk about her situation, is in dire financial straits currently. She's unable to work at

the moment due to an injury but is keen to get back into the workforce. She is a

highly skilled worker in her field and just needs someone on her side. Welfare

payments barely cover her rent and bills. She is at breaking point and came to me in

a desperate state.

I would never want to see any government department, financial institution or any

other organisation, for that matter, contribute to a woman's ongoing trauma and

abuse. Ending violence against women and children, including financial abuse, is

everybody's responsibility and business. We can all play a role in prevention, whether

as colleagues in the workplace, workers in the community, financial institutions, local

sporting groups and other community organisations or parents, carers, family and

friends.

Ms Ryan (Kooyong): I am very pleased to support the

motion from the member for Swan. Financial and economic abuse are forms of

domestic violence. They are patterns of abusive behaviour by which an abuser uses

money to exert power and control over their partner. Last year, more than 600,000

Australians were victims of financial abuse. Ninety per cent of women seeking help

from domestic violence services report that they have experienced financial abuse,

and we know that these figures underestimate the extent of the issue.

Financial abuse is prosecuted in different ways. Some people take out loans and

credit cards in their partner's name, leaving them with debts and compromised credit

ratings for years after the relationship ends. Some abuse their partners by not

allowing them to work, by limiting their spending money, by forcing them to make

early withdrawals from their superannuation, by making them take on debt against

their will or sometimes even their knowledge or by taking control of their social

security benefits.

Like all forms of domestic violence, financial abuse can happen to anyone regardless

of their wealth or social economic status. It often develops and evolves insidiously.

Coercive control, including financial abuse, is commonly described by victimsurvivors as the worst form of abuse that they experienced. It can have a more

immediate and ongoing impact than physical forms of violence, but it is also a

predictor of severe physical violence and even homicide.

Sadly, we have to acknowledge that the disabled are particularly susceptible to this

form of abuse. The disability royal commission found that disabled women are

abused almost twice as often as non-disabled women. Perpetrators can be anyone in

the victim's life, but they are often their caregiver. Lack of access to financial

resources and barriers to accessing social security entitlements can increase the risk

of financial abuse of disabled people. Other forms of financial abuse against those

people may include legal guardians denying access to money, services withholding

disability support or government payments and support workers misusing National

Disability Insurance Scheme funds.

I have heard repeatedly from women in Kooyong about this issue. They have told me

that they feel that their abusers are never held to account despite multiple reports

filed with police and domestic violence orders against their perpetrators. In their

view, sadly, police seem unable to act on allegations of coercive control, even when

those perpetrators are in breach of court orders. I have heard from women who have

lost their homes and who are now homeless due to financial abuse and forced to

couch surf with friends. I am also hearing from many women who are distressed by

the incidence of domestic violence in Australia more broadly about the anger that

they feel that so little is done to curb the violence perpetrated against them.

There are several steps that we can take, and that we must take, to address the

important issue of financial and economic abuse. Firstly, we must support the

existence of family violence financial counsellors to help abused individuals make a

case for their debts to be waived or to be transferred back to the abusive family

member. We should encourage large businesses to understand the need for policies

and procedures that support customers who are experiencing domestic financial and

economic abuse. I applaud the efforts of the Commonwealth Bank and other

institutions which are working to report technology facilitated abuse to law

enforcement. Major businesses should provide trauma informed, culturally safe

support, promoting the safety and wellbeing of survivors and holding people who

choose to use this sort of violence to account. We have to improve police responses

and we have to improve the way that the justice system supports victim-survivors.

Finally, we need to legislate a specific criminal offence of coercive and controlling

behaviour in all states and territories of this country. We have to ensure that people

who choose to use coercive control are held to account. Despite being one of the

most insidious and most common forms of domestic violence, coercive control has

been legislated as a standalone offence only in Tasmania. Movement in other states

and territories has been too slow to date. We can and we must do more to protect

Australians from financial and economic abuse.

Mr DAVID SMITH (Bean—Government Whip) (17:04): Financial

abuse is, without a doubt, a form of domestic and family violence. It can leave

victims and survivors in unfathomable positions. Many do not recover; many do not

survive. This must end. That is why I support this motion's unequivocal

condemnation of the use of bank accounts to perpetrate abuse, the use of money to

control victims of economic abuse, and the disgraceful exploitation, and in some

cases sabotage, of a person's finances to undermine their financial security and limit

their ability to be independent and self-sufficient.

As the world continues to transition to online financial services, the rates of financial

abuse are going to continue to increase if we do not act. A 2017 study on economic

abuse between cohabiting partners found that 16 per cent of women and seven per

cent of men had experienced financial abuse in their lifetimes. This study also

established that age, disability, financial stress and health status were significant risk

factors, especially for women. For example, 63 per cent of women who experienced

high financial stress and 24 per cent of women with disability or long-term health

conditions had experienced financial abuse as well. Middle-aged and older women

also more commonly experienced financial abuse.

Many members of this House may have friends or family with firsthand experience of

this type of abuse. I certainly have, and I saw that abuse cross and damage

generations. It's critical that all governments work together on these issues.

Inconsistency will cost lives and livelihoods. That's why governments at all levels

need to be pulling in the same direction. As my colleagues have touched on, this

issue cannot be left to one party, one government or one state or territory, nor can

the resolution be left to a small part of the community. That is why this government,

in partnership with state and territory governments across Australia, is committed to

addressing the underlying factors that drive gender based violence as well as rates of

violence.

Through the National Plan to End Violence against Women and Children 2022-2032

that we released along with the states and territories last year, this government has

set a goal to end violence against women and children in one generation. The

National Plan to End Violence against Women and Children aims to address the

underlying drivers of gender based violence to prevent violence before it occurs; to

intervene early and prevent further escalation; to respond appropriately when

violence is used; and to support the recovery and healing of victims-survivors in

ways which put them at the centre.

The Albanese government has invested $2.3 billion in women's safety, including

more than $326 million in prevention initiatives specifically across our first two

budgets. This includes funding for initiatives like our consent and respectful

relationships education, sexual violence prevention pilots and funding to support the

work of Our Watch, the national leading organisation for the primary prevention of

family, domestic and sexual violence in Australia.

Ending violence against women and children is everybody's responsibility and

everybody's business. If we are to successfully end violence in one generation, we

must ensure our social security safety net recognises the circumstances of people

who are experiencing violence. Victims of family, domestic and sexual violence

should not be unfairly punished as a result of how their relationship is recognised

under social security law.

Finally, I thank the member for Swan for moving this motion and for the leadership

she has demonstrated on this issue. There will be many victims, survivors and

organisations who will be empowered by the strong stance this parliament has taken

on this issue, as well as by this parliament's united commitment to victims and

survivors of financial abuse to ensure that we as a nation can enable generational

change and eliminate it.

Mr VIOLI (Casey) (17:09): I want to echo the member for Bean's

words but also commend the member for Swan for this motion. It's a tough subject

to talk about, but sometimes the toughest subjects are really the most important to

talk about. We have an important role in this House in shining a light on challenging,

difficult issues that impact a lot of people.

A habit that I've had for many years is, on a Sunday, to read the Barefoot Investor in

the local paper, and I've always found it good; he was a great financial adviser,

unofficially, to me, growing up, and I took on his 'buckets' theory. Reading it is

something I've continued to do, because it gives me a great perspective on issues

and challenges that people have, and, as an MP, I've found it quite helpful in that

regard as well.

On the weekend, there was a letter to him written by someone called Denise that

really touched me at the time, and I think it's appropriate that I share it now, just to

put a real person and a real story behind what we're talking about when we talk

about financial abuse and the impact it will have. These are Denise's words. 'Dear

Scott, I've been married for 35 years, and I am scared. I'm only 81 days away from

accessing my super balance, which is $30,000. I need to take that money and escape

from my husband. I would be leaving a property worth $1.7 million. Nothing is in my

name, only the debt of $170,000 that is left on the mortgage. I know I'm losing

everything I've worked for, but I'm scared of him and scared that he can take what I

have left. I feel I need to take the money and go overseas so he can't find me.' When I

read that on Sunday, it hit me hard. There's a lot in that that's challenging. There's

obviously Denise's situation, but I think many in this House, reading that or listening

to that at home, would realise the options she has and the reality. How can he own

the $1.7 million house but she owe the debt? It defies financial logic.

But we all, outside of the situation, understand that this is the perverse nature of

financial abuse, domestic violence and the control that is exhibited in a partnership.

It's important that we shine a light on that.

Scott did give Denise some good advice, and I hope she takes that up. And to anyone

listening at home who is in a tough situation: there is support out there for you; you

have more options and more rights than you know. It's important that, across the

aisle, we—the government, the states, the not-for-profits and the banks—all work

together to support those who don't think they have an option.

Let's not pretend this is an easy situation. And I'm not at all trying to be political. I

commend the government. Many have spoken about their strategy. It is important

that we have a strategy and we work together. So I'm not, in any way, saying this to

be political. But we need to acknowledge that it is complex and challenging. There

are other issues at play, as well, with that domestic violence. Often, there's substance

abuse; often, there are challenges from socioeconomic status. We need to recognise

that and to not judge those in these situations but provide them with options and

information.

We also need to remember that, in many of these cases, there are young children and

families that are involved. We need to think about what those children are seeing,

what they're learning and what impact it's having on them. How can we help break

the cycle and give them a safe place?

I know that they're only a little thing, but breakfast programs at schools are vital. My

wife is a teacher's aide, and I know the impact it has to give those who need it a little

bit of normality. It's important that we do what we can to continue to break that cycle

and to allow children to understand that it's not acceptable behaviour; it's not

normal.

The unfortunate reality in Victoria, with the lockdowns, was that many children were

exposed to significant and difficult situations. We need to keep continuing to support

those children and support those mothers that are caught in these tragic situations.

So I commend the member for Swan for shining a light on this challenging issue.

The DEPUTY SPEAKER ( Mr Stevens ): The time allotted for this

debate has expired. The debate is adjourned and the resumption of the debate will

be made an order of the day for the next sitting.